by Christal Céleste | Mar 27, 2024 | Things To Do

Nestled in the heart of Monaco, Casino Square is more than just a gambler’s paradise. It’s a vibrant hub where luxury and leisure meet, offering a plethora of experiences beyond the roulette wheel. I’ve wandered its opulent surroundings, discovering that there’s a world of adventure waiting just steps away.

From lush gardens that whisper tranquility to the roar of Formula 1 cars, the area surrounding Casino Square is a treasure trove of experiences. I’ve sipped on world-class cocktails with breathtaking views and delved into cultural depths that span centuries.

Join me as I share the top picks for things to do near Casino Square that promise to enrich your visit with memories worth betting on.

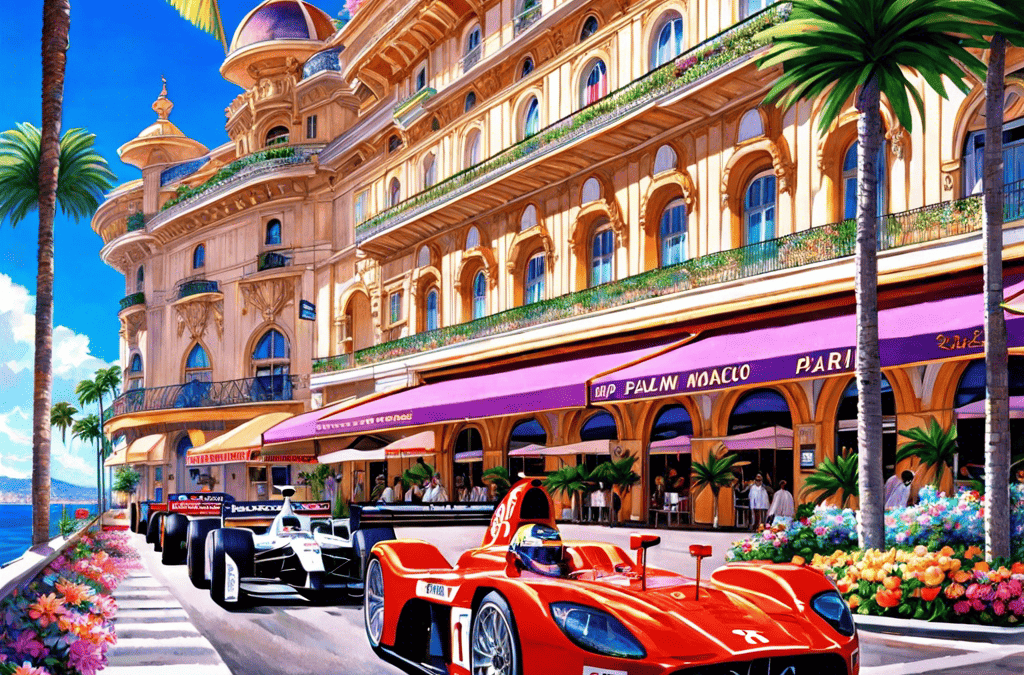

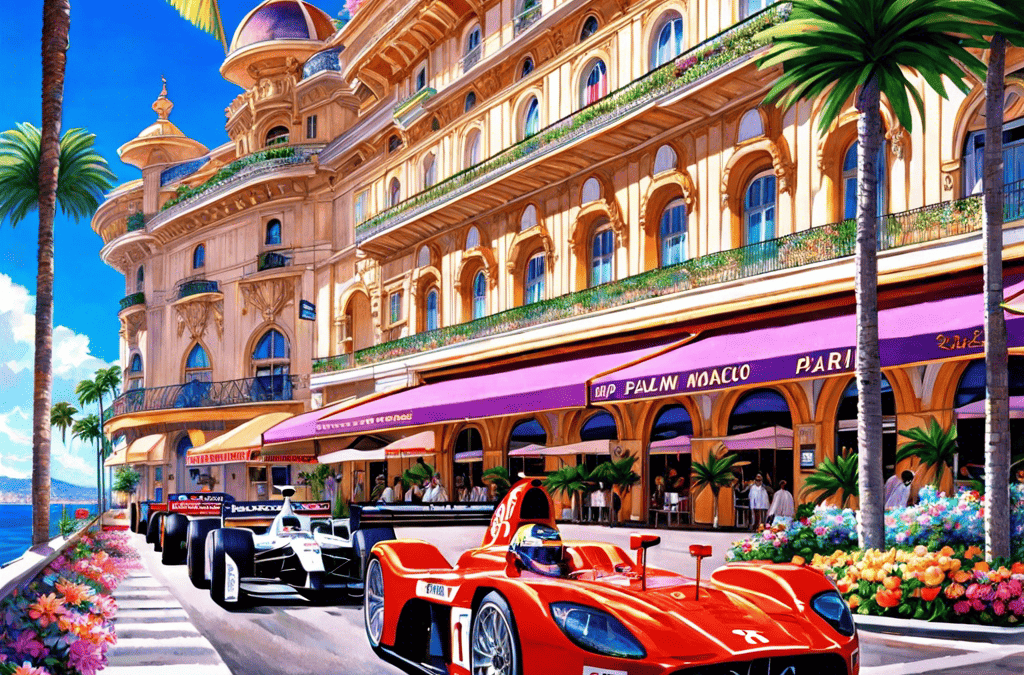

Experiencing the Thrill of Formula 1 Races

When I think of Monaco, the roar of Formula 1 cars zipping through the narrow streets during the prestigious Monaco Grand Prix immediately comes to mind. This iconic race transforms the streets around Casino Square into a high-speed circuit that’s both a driver’s dream and a challenge.

It’s an event that embodies the essence of speed, glamour, and skill, making it an absolute must-experience for any visitor in the area during race season. The Monaco Grand Prix is one of the most famous races in the world, and its circuit is renowned for being particularly demanding.

With tight corners, elevation changes, and a tunnel, it’s a test of skill for the world’s best drivers. Watching them navigate the track at breakneck speeds, just inches away from the barriers, is a heart-pounding experience. It’s not just about the race itself; the entire city buzzes with excitement.

The atmosphere is electric, with fans from all over the globe gathering to witness this spectacular event. For those planning to catch the race, securing a good vantage point is key.

While grandstand seats offer fantastic views of specific sections of the track, there are also various spots around the city where one can catch glimpses of the action for free. However, for a truly unforgettable experience, I’d recommend splurging on a balcony or yacht spot.

These premium options provide not only exceptional views of the race but also a taste of the luxurious lifestyle Monaco is famous for.

Aside from the race, the Monaco Grand Prix weekend is filled with events and activities that celebrate the sport of motor racing.

From autograph signing sessions with the drivers to public pit lane walks, there are plenty of opportunities for fans to get up close and personal with the stars of Formula 1.

The harbor area, with its lineup of superyachts, becomes a party hub, hosting glamorous events and parties that last well into the night. Being part of the Monaco Grand Prix is an exhilarating experience that goes beyond just watching a motor race.

It’s about being immersed in a world of luxury, excitement, and speed. The memories I’ve made here, from the deafening sound of the cars to the spirited cheers of the crowd, are unforgettable. It’s a unique blend of sporting excellence and opulent spectacle that truly captures the spirit of Monaco.

Exploring the Bustling Casino Square

The Grand Prix Casino Square pulsates with an energy unlike any other. The clinking of chips mingles with the murmur of conversation in a dozen languages, creating a constant hum of activity. The air thrums with a tangible anticipation, a shared undercurrent of glamorous possibility.

As I wandered beneath the grand Belle Époque facades, I couldn’t help but be swept up in the spectacle. Luxurious cars glided past, their polished surfaces reflecting the vibrant neon signs that bathed the square in a warm glow.

Elegant couples strolled hand-in-hand, their attire hinting at the opulent evening ahead. Even the non-gamblers, like myself, were drawn into the intoxicating atmosphere.

Street performers added a touch of whimsy, with acrobats defying gravity and magicians weaving illusions that left me awestruck. Beyond the allure of the casinos themselves, Casino Square is a captivating stage, a place where people watching is an art form in itself.

A group of impeccably dressed musicians played a lively jazz piece, their smooth melodies weaving through the throng. I witnessed a group of friends celebrating a big win, their joyous cheers echoing across the square.

But Casino Square isn’t just about extravagance. Tucked away in a corner, I stumbled upon a charming chess club. Elderly gentlemen, their faces etched with years of experience, sat hunched over intricately carved chessboards, their concentration palpable. It was a delightful juxtaposition to the fast-paced world of roulette and blackjack happening just steps away.

As dusk settled, the lights of the casinos truly came alive, casting a mesmerizing spell over the entire square. It was a scene straight out of a James Bond movie, and for a moment, I couldn’t help but feel like I was part of something extraordinary.

Shopping Extravaganza

Casino Square transforms into a shopper’s paradise as you step beyond the clinking of chips and onto streets lined with prestigious boutiques. Window shopping here is an art form in itself. Intricate displays showcase the latest collections from world-renowned fashion houses.

Dresses shimmer with sequins under the Mediterranean sun, while perfectly tailored suits hang like silent testaments to impeccable craftsmanship. The air carries a subtle fragrance of expensive leather and exotic perfumes, further amplifying the sense of luxury.

A quick peek inside one of these designer stores reveals a world of personalized service. Attentive salespeople with impeccable taste stand ready to assist, their knowledge of the latest trends as vast as their understanding of their clientele’s desires. But for those who prefer a more independent exploration, simply strolling past the window displays is a visual feast.

The experience isn’t limited to just high fashion. Dazzling jewelry stores beckon with sparkling diamonds and exquisite gemstones. Each piece is a work of art, a miniature masterpiece waiting to adorn a lucky wrist or grace a sophisticated neckline.

Even for those not planning a major purchase, the opportunity to admire the craftsmanship and artistry behind these exquisite pieces is a treat in itself. The energy in these stores pulsates with a quiet excitement, a shared appreciation for the finer things in life.

Exploring the Lavish Gardens

One of my absolute favorite things to do near Casino Square, Monaco, doesn’t involve stepping inside a casino at all. It’s wandering through the lavish gardens that are peppered around this extravagant locale. The experience is like stepping into a living painting, where every turn reveals a new brush stroke of natural beauty coupled with meticulous design.

First up on my list is the Japanese Garden. Nestled just a stone’s throw away from the bustling Casino Square, this garden is a serene oasis. Inspired by the Zen philosophy, its design incorporates water features, stepping stones, and carefully pruned greenery that transport you to a tranquil corner of Japan.

I’ve spent countless hours just sitting by the pond, watching the koi fish glide effortlessly through the water. It’s a stark contrast to the fast-paced energy of the city and provides a much-needed respite.

Then there’s the Saint Martin Gardens, a lush, verdant space that offers panoramic views of the Mediterranean Sea.

The paths here are lined with a diverse array of Mediterranean flora, attracting a colorful variety of birds and butterflies. It’s not just a feast for the eyes; the fragrant herbs and flowers ensure that a stroll through Saint Martin Gardens is a multisensory experience. I always make it a point to pause for a moment on one of the benches, taking in the sights, sounds, and scents that envelop me.

But the highlight for any botanical enthusiast or lover of beauty has to be the Exotic Garden of Monaco. Perched on the side of a cliff, this garden is a testament to human ingenuity and nature’s splendor. It houses an impressive collection of succulent plants, especially cacti, from all corners of the globe.

The garden not only showcases the diversity of these resilient plants but also offers breathtaking views over Monaco and the azure waters of the Mediterranean beyond. The path winds its way through the garden, ensuring visitors get to admire every unique plant on display.

Delving into Centuries of Culture

After savoring the innovative cocktails and gourmet treats near Casino Square, I felt a pull towards exploring the rich cultural tapestry Monaco has to offer. My curiosity led me into the heart of Monte Carlo, where centuries of history and culture wait to be discovered by enthusiastic visitors like me.

First on my list was the Monte Carlo Opera House. Known for its exceptional acoustics and breathtaking Belle Époque architecture, this venue left me spellbound. Every corner tells a story, with ornate frescoes and sculptures filling the space. I learned that it’s been a cultural beacon since 1879, hosting world-renowned operas and ballets. Just standing in the opulent auditorium made me feel like I was part of Monaco’s glamorous history.

Next, I wandered over to the Oceanographic Museum. Perched on the edge of The Rock, the museum offers a deep dive into marine sciences, with a blend of history, art, and biology that’s rare to find. The exhibitions ranged from rare species of fish to interactive displays about marine conservation efforts. It was enlightening to see how Monaco contributes to oceanic research, making me appreciate the principality’s dedication to preserving our planet’s underwater worlds.

The Prince’s Palace was another must-visit. Each summer, the state rooms open to the public, offering a glimpse into the luxurious lives of Monaco’s rulers. The Italian-style gallery and the Louis XV bedroom were particularly impressive. But it was the changing of the guard that truly captivated me. This precise ceremony is a daily tradition that embodies Monaco’s rich heritage and respect for tradition.

As I moved through these historical sites, I realized how Monaco’s culture is a blend of grandeur and scientific curiosity. Each location had its own story, contributing to the mosaic that defines this tiny yet fascinating country.

Unwinding at Luxurious Spas

After a day of soaking in Monaco’s cultural and historical wonders, I decided to treat myself to some much-needed relaxation. Monaco, known for its opulence and luxury, boasts some of the most exquisite spas in the world, and they’re all a stone’s throw away from Casino Square.

My first stop was the renowned Thermes Marins Monte-Carlo. Overlooking the Mediterranean, this spa is a sanctuary of wellness. With a heated seawater pool, various saunas, and hammams, I instantly knew I was in for a treat. Their holistic approach, focusing on both physical and mental well-being, resonated with me. I opted for a deep tissue massage followed by a seaweed wrap. The experience was nothing short of transformative, leaving my body invigorated and my mind at peace.

Next on my list was the Spa Metropole by Givenchy. Nestled within the opulent Hotel Metropole, this spa is the epitome of luxury. The ambience is captivating, with each treatment room designed to ensure privacy and tranquility. I was particularly intrigued by their signature treatments, which incorporate Givenchy’s sophisticated beauty products. The “Le Soin Noir Facial,” known for its rejuvenating properties, was an absolute revelation. My skin had never felt smoother nor more radiant.

Throughout my spa-hopping journey in Monaco, I discovered a few noteworthy aspects.

The Emphasis on Personalization

Each spa went above and beyond to tailor treatments to my specific needs. Whether it was a massage that focused on stress points or a facial adapted to my skin type, the personalized touch was apparent and much appreciated.

The Fusion of Tradition and Innovation

While Monaco’s spas are steeped in history, they seamlessly integrate the latest advancements in wellness and beauty. From cutting-edge skin treatments to traditional therapeutic massages, the blend of old and new is fascinating.

Sustainability Efforts

I was pleasantly surprised to learn about the sustainable practices implemented by many of these establishments. From the use of organic products to initiatives aimed at conserving water and reducing waste, it’s clear that Monaco’s luxury spas are committed to environmental stewardship.

Stepping into Thermes Marins Monte-Carlo, the sparkling Mediterranean stretched out before me, transforming the space into a sanctuary of wellness. Their commitment to personalization, innovation, and sustainability left me feeling pampered, invigorated, and ready to conquer the evening. Perhaps a perfectly crafted cocktail would be the ideal way to celebrate?

Indulging in World-Class Cocktails with a View

Emerging from the tranquil oasis of Thermes Marins Monte-Carlo, a different kind of exhilaration beckoned. Équivoque Rooftop Bar, perched above the vibrant cityscape, offered a breathtaking Mediterranean vista that served as the first sip of a truly sensory experience. Here, cocktails transcended mere drinks; they were meticulously crafted masterpieces, a testament to precision and flair.

Each sip is a journey through exotic flavors and premium spirits. A personal highlight was their signature “Jardin Secret,” infused with local lavender and a hint of citrus, a delightful homage to the Riviera’s botanical treasures. The delicate lavender balanced the citrus perfectly, creating a refreshing and elegant drink that embodied the essence of the sunny Riviera. It was as if the very essence of the landscape had been captured in a glass.

As I savored this delightful concoction, the world seemed to melt away, replaced by the panoramic view stretching out before me. The sparkling turquoise water, dotted with yachts, and the vibrant city lights twinkling in the distance created a scene straight out of a dream. This tranquil escape is precisely the feeling you can chase during the adrenaline rush of the Grand Prix.

Here are my best bar tips for replicating this kind of relaxing bar experiences during the Grand Prix weekend.

Sky-High Sips and Riviera Delights

My first stop was the Équivoque Rooftop Bar, boasting an unparalleled panorama of the Mediterranean. Here, cocktails are elevated to art forms. Each meticulously crafted sip is a journey through exotic flavors and premium spirits. A personal highlight was their signature “Jardin Secret,” infused with local lavender and a hint of citrus, a delightful homage to the Riviera’s botanical treasures.

A Speakeasy Sojourn

A short stroll away, nestled on a quieter street, I discovered a hidden gem – Le Bar Américain at Hôtel de Paris. This intimate bar offered a stark contrast, focusing on classic cocktails. It felt like stepping into a bygone era where bartenders were revered artisans. Here, I savored a perfectly balanced Negroni, the ideal F1 race antidote with its bitter-sweet symphony.

Beyond the Drinks

These captivating cocktail experiences were complemented by delectable small bites, from artisan cheeses at Équivoque to freshly prepared seafood canapés and the delightful warmth of Babajuan, a Monegasque specialty, at Le Bar Américain. Each morsel was a sensory delight, elevating the entire experience into a symphony for the senses.

Innovation in a Glass

Venturing further, I arrived at a haven for the adventurous imbiber – Blue Gin at the Monte-Carlo Bay Hotel & Resort. This bar pulsates with creativity, mirroring the energy of Monte Carlo’s nightlife. Their interactive cocktail menu allows guests to tailor drinks to their mood or flavor preferences. I opted for something daring – a concoction with a spicy kick and a hint of sweetness, echoing the day’s exhilarating events.

Fine Dining Delights

Venturing beyond the flashing lights and lively chatter of Casino Square, a different kind of indulgence awaits. Monaco boasts a world-class dining scene, where Michelin-starred restaurants and iconic establishments vie for the attention of discerning palates.

One evening, I found myself at a renowned establishment overlooking the sparkling Mediterranean. Crisp white tablecloths flowed down to the floor, and floor-to-ceiling windows offered a breathtaking vista of yachts bobbing gently on the azure water.

The service was impeccable, with waiters gliding effortlessly between tables, their every movement an unspoken promise of an exceptional experience.

The menu itself was a symphony of flavors, a meticulously curated selection of seasonal ingredients and culinary artistry. Locally sourced seafood featured prominently, each dish a testament to the bounty of the surrounding waters. I savored a dish of pan-seared scallops with a delicate saffron sauce, the flavors dancing on my tongue.

Every bite was a revelation, a testament to the chef’s dedication to transforming simple ingredients into culinary masterpieces. For those seeking a more casual yet undeniably luxurious atmosphere, al fresco dining on a balmy summer evening is an experience not to be missed.

Charming sidewalk cafes dot the streets around Casino Square, each offering a unique perspective of the vibrant scene. While indulging in a plate of perfectly prepared pasta or a juicy steak, the world becomes a stage, a constant parade of elegant people and luxurious cars providing a captivating backdrop to the culinary delights.

Monaco’s fine dining scene caters to all palates and preferences, offering an unforgettable fusion of exquisite flavors, impeccable service, and breathtaking surroundings.

Insider Tips for a Blissful Monaco Grand Prix Weekend

Book Early: Accommodation and popular bar/restaurant reservations fill up fast during Grand Prix weekend. Secure your spots well in advance for a stress-free experience.

Consider Public Transport: Traffic and parking are nightmares during the race. Utilize Monaco’s efficient public transportation system or explore by foot to avoid the congestion.

Dress to Impress (Casually): While Monaco leans towards glamour, comfort is key for navigating crowds. Pack stylish yet comfortable walking shoes and elevate your outfit with chic accessories.

Embrace the People-Watching: Casino Square is a vibrant stage during Grand Prix weekend. Grab a seat at a cafe, sip your drink, and soak in the atmosphere of the well-heeled crowd and F1 enthusiasts.

Explore Beyond the Square: Venture outside the immediate Casino Square area. Charming streets in Monte Carlo offer hidden gems like cafes and boutiques.

Pack Light Layers: Weather in Monaco can be unpredictable. Be prepared for sunshine, a cool breeze, or even a sudden shower with light layers you can easily adjust.

Bring Cash (Euros): While many places accept cards, some smaller cafes or street vendors might prefer cash. Having Euros on hand ensures a smooth experience.

Learn Basic French Phrases: A few basic French pleasantries go a long way with locals and can enhance your interactions.

Enjoy the Buzz, but Pace Yourself: The energy is electric, but don’t overdo it. Schedule downtime to recharge and avoid burnout during the action-packed weekend.

Explore Post-Race Deals: Some hotels and restaurants may offer special deals or packages catering to post-race relaxation, so keep an eye out for these opportunities.

Pack Earplugs (Optional): The roar of the engines can be exhilarating, but also overwhelming for some. Consider packing earplugs, especially if you plan on spending extended periods trackside.

Hydrate: Monaco’s weather can be hot, especially during the hustle and bustle of the race. Carry a refillable water bottle and stay hydrated to avoid overheating and fatigue.

Sunscreen and Hat: Sun protection is essential. Pack sunscreen with a high SPF and a hat to shield yourself from the Mediterranean sun.

Download Essential Apps: There are several helpful apps for navigating Monaco during the Grand Prix. Consider apps for public transportation schedules, restaurant reservations (if not booked in advance), and a French phrasebook translation app.

Haggling is Not Expected: Unlike some markets, haggling over prices is not common practice in Monaco. Be prepared to pay the listed price for goods and services.

Tipping Etiquette: Tipping is not mandatory in Monaco, but a small gratuity (around 10%) is always appreciated for good service at restaurants and bars.

Respect the Local Culture: Monaco is a small principality with its own customs and traditions. Dress modestly when visiting religious sites, be mindful of noise levels, and avoid littering.

Embrace the Unexpected: Sometimes, the best experiences come from unplanned moments. Be open to exploring side streets, striking up conversations with locals, or trying a new activity on a whim.

Capture Memories, But Disconnect to Fully Enjoy: While capturing photos and videos is a natural part of the experience, try not to get overly focused on documenting everything. Put your phone down at times to truly immerse yourself in the atmosphere and create lasting memories.

Bring Back Unique Souvenirs: Skip the generic tourist trinkets. Look for local crafts, artisanal food products, or small pieces of art from Monegasque designers as keepsakes that reflect the unique character of the place.

Conclusion

Exploring Monaco’s vibrant culture and indulging in its luxurious spa experiences has been nothing short of magical. From the adrenaline-pumping Monaco Grand Prix to the serene moments at Thermes Marins Monte-Carlo and Spa Metropole by Givenchy, I’ve found a delightful balance between excitement and relaxation.

It’s clear that Monaco excels in offering a unique blend of tradition, innovation, and sustainability, especially in its spa industry. Whether you’re here for the thrill of the race or the tranquility of a spa day, Monaco promises an unforgettable experience.

For me, it’s been an adventure that beautifully marries luxury with well-being, one I can’t wait to dive into again.

by Christal Céleste | Mar 12, 2024 | Things To Do

Planning a family trip to Monaco and wondering if it’s kid-friendly? Well, I’m here to tell you, it’s a playground not just for the rich and famous, but for little adventurers too! From its sparkling coastline to the fascinating streets filled with history, Monaco offers a unique blend of educational and fun-filled activities that are perfect for kids.

I’ve explored Monaco with my own little ones and was pleasantly surprised at how much there is to do. Whether you’re looking to dive into the world of marine life, spend the day in beautifully curated gardens, or get a taste of royalty at the Prince’s Palace, there’s something in Monaco for every curious young mind. Let’s dive into some of the best activities that’ll make your family trip to Monaco unforgettable.

1. Exploring the Oceanographic Museum

things to do in monaco with kids

One of the highlights of our Monaco adventure with the kids was undeniably our visit to the Oceanographic Museum. Known for its monumental architecture perched on the cliffside, this centenary establishment brings together art, history, and science under one roof—a trifecta that fascinated not just my kids but me as well.

As we stepped inside, the grandeur of marine life unfolded before our eyes. It’s not just an aquarium; it’s an immersive experience that brings you face-to-face with the diversity and beauty of the ocean’s inhabitants. We were enthralled by the colorful displays of coral reef ecosystems housing exotic fish and the hypnotic dance of the jellyfish in their tanks. It was educational yet entertaining, a rare combination that captured our imagination and sparked inquisitive conversations among us.

The tactile touch pool was an instant hit with the kids. They got the chance to gently interact with sea urchins and starfish, an encounter that brought squeals of delight and wonder. I appreciated the educative talks by the museum staff who were eager to share stories about marine conservation, inspiring the kids with messages on how to protect these fragile ecosystems.

Not to be missed is the Whale Room, housing a collection of marine mammal skeletons that are both awe-inspiring and a bit humbling. Standing beneath the giant whale skeleton, we couldn’t help but feel a profound connection to these majestic creatures of the deep. It served as a reminder of the ocean’s vastness and mystery.

The museum also boasts a panoramic rooftop terrace offering spectacular views of the Mediterranean Sea. While the kids enjoyed spotting boats and yachts, I took a moment to soak in the breathtaking vista. It’s these serene moments amidst the excitement that truly enrich the travel experience.

Our journey through the Oceanographic Museum was as educational as it was enchanting. With each exhibit, from the rare fish species to the interactive zones, it was clear that this place is designed to kindle curiosity and appreciation for the marine world. The staff’s dedication to providing a memorable experience is apparent throughout, making it a must-visit for families in Monaco.

Exploring the Oceanographic Museum not only offered us a wonderful day out but also the opportunity to learn about marine life conservation efforts. It’s these kinds of activities that add significant value to our travels, making them not just fun but impactful as well.

Here are the highlights in summary:

The Maritime Odyssey

Immerse your family in the wonders of the ocean. The museum’s impressive collection of marine specimens and interactive exhibits will leave kids in awe. Don’t miss the Shark Lagoon, where you can safely observe these majestic creatures from behind the glass.

Interactive Zones for Junior Explorers

It’s not just about looking at fish. The museum’s interactive zones are designed to engage and educate young minds. Touch pools allow children to feel starfish and sea urchins, while workshops and presentations provide deeper insights into marine biology.

2. Strolling through the Princess Grace Rose Garden

things to do in monaco with kids

After spending a lively morning exploring the depths of marine life at the Oceanographic Museum, I couldn’t wait to indulge my senses in a more serene, natural environment. So, I led my family to the Princess Grace Rose Garden for a leisurely stroll, and I must say, it was everything I had hoped for and more. Nestled in the Fontvieille Park, this garden is a tranquil haven dedicated to the memory of Princess Grace of Monaco.

Walking through the entrance, we were immediately enveloped in the delicate fragrance of roses. It’s amazing how this garden, spread over almost four hectares, is home to over 8,000 rose bushes from around 300 different varieties. Each step we took offered a new scent, a new hue, and a new story. My kids were particularly fascinated by the vibrant colors and the bees and butterflies flitting from bloom to bloom. I found it to be the perfect opportunity to teach them about the importance of pollinators in our ecosystem.

One of the most magical moments for us was finding the Heart of the Princess sculpture, nestled among the roses. The sculpture, a tender tribute, symbolizes the love and respect the people of Monaco continue to hold for Princess Grace. It was a touching reminder of the garden’s deeper meaning, beyond its beauty.

What’s more, the meticulously maintained paths made it easy for us to navigate the garden. The clear signages not only guided our way but also educated us about the different species of roses. I appreciated how well-designed the garden was, ensuring that everyone, regardless of age or mobility, could enjoy the beauty on display.

The Princess Grace Rose Garden also features a charming little café snug in one corner. After meandering through the myriad of paths, we decided to take a break and savor some refreshments. Sitting there, sipping lemonade under the shade of an umbrella, and basking in the idyllic setting was pure bliss. It was the perfect spot to relax and absorb the natural beauty around us.

3. Visiting the Prince’s Palace of Monaco

things to do in monaco with kids

My next adventure with the kids led us to the iconic Prince’s Palace of Monaco. Nestled atop the Rock of Monaco, this historical palace isn’t just a marvel of medieval architecture; it’s a living testament to the rich history and culture that have shaped this small, yet fascinating country. From the moment we approached its grand entrance, the kids were awestruck by the sheer beauty and scale of the building, eagerly anticipating what lay inside.

One of the highlights of our visit was the changing of the guard ceremony. Performed daily at 11:55 AM, it’s a spectacle that captivates both young and old alike. My kids were glued to their spots, watching the guards in their crisp uniforms perform with precision. It’s a perfect example of Monaco’s traditions being kept alive through generations.

Exploring the palace’s state rooms was like stepping into a fairytale. We were all amazed by the opulent decor, intricate tapestries, and stunning frescoes. Each room had its own story, with informative signages that offered glimpses into the lives of the ruling Grimaldi family over the centuries. The kids especially loved the Throne Room, with its lavish decorations and grandeur, imagining themselves as royalty.

The palace also offers audio guides that are tailored for children. These guides made the tour more engaging for them, explaining the history and significance of each room in a way that was both fun and educational. I found it to be a fantastic way to spark their interest in history and culture, making our visit not just entertaining but informative as well.

After touring the inside, we ventured outside to explore the palatial gardens. The meticulously maintained landscapes were breathtaking, offering panoramic views of Monaco and the Mediterranean Sea. We took our time strolling through the gardens, enjoying the serene atmosphere and the stunning floral displays. It was a peaceful retreat after the excitement of the palace tour.

One practical tip for visiting the Prince’s Palace with kids is to check the official website for opening times and any special events that might be taking place. Planning ahead ensures you won’t miss out on any of the experiences the palace has to offer, from the changing of the guard to special exhibitions that are often held within its walls.

Royal Encounters: Prince’s Palace and the Changing of the Guard

Every day at 11:55 AM sharp, the Prince’s Palace becomes the stage for a ceremonial tradition. The changing of the guard is a spectacle of precision and pageantry that children find fascinating. It’s a slice of Monaco’s history presented in a way that’s accessible to all ages.

The Splendor of the Monaco Royal Residence

The Prince’s Palace isn’t just a backdrop for the guard change; it’s also a historical treasure trove. While the interior is open to visitors during the summer months, the exterior alone is worth the visit. The palace’s Italianate façade provides a lesson in architecture that’s as grand as it is educational.

Schedule and Best Spots for Viewing

To get the best view of the guard change, arrive early and find a spot in the Palace Square. It’s a popular event, so securing a good vantage point is key. Besides that, it’s an opportunity to soak in the atmosphere of Monaco’s old town, Monaco-Ville.

4. Unearth Botanical Treasures: The Exotic Gardens of Monaco

things to do in monaco with kids

Imagine a place where towering cacti and rare succulents reach for the sky, creating a natural playground that feels like another world. This is the Exotic Garden of Monaco, a place where families can explore and learn about desert plants and their adaptations to harsh environments.

A Home to Thousands of Rare Plants

The Exotic Garden is home to an impressive collection of plants from arid regions around the globe. As you wander through the garden, you’ll encounter a diverse array of botanical species, each with its unique story. The garden’s layout is designed to fascinate both the young and the young at heart, making it a perfect educational stop.

The Great Cactus Adventure

Among the many highlights of the Exotic Garden is the cactus collection. Children will be amazed at the variety of shapes and sizes these prickly plants can take. It’s an adventure that’s both visually stimulating and informative.

-

Learn about the different cactus species and their habitats.

-

Discover how these plants conserve water and thrive in desert conditions.

-

Take a guided tour to get insider knowledge about the garden’s conservation efforts.

With over a thousand species to see, the Exotic Garden is a testament to the resilience of life and a reminder of the importance of plant conservation.

5. Monaco-Ville: The Rock’s Historical Heartbeat

things to do in monaco with kids

Step back in time as you stroll through the narrow, picturesque streets of Monaco-Ville, also known as Le Rocher (The Rock). This historic district is the old town of Monaco and offers a charming escape from the modern glitz of the city.

The Storybook Streets

Wandering through Monaco-Ville feels like walking through the pages of a storybook. The well-preserved medieval buildings, with their colorful facades and historical plaques, tell the tales of a bygone era. It’s an immersive experience that sparks the imagination of young explorers.

Museum Mile for Minis

Monaco-Ville is not just about history; it’s also home to several museums that cater to curious minds. The Museum of Napoleonic Souvenirs and the Collection of the Palace’s Historic Archives offer glimpses into the life and times of the Grimaldi family, while the Stamps and Coins Museum showcases Monaco’s rich philatelic and numismatic history.

6. Enjoying a Family Day at Larvotto Beach

things to do in monaco with kids

After our memorable visit to the Prince’s Palace and Monaco’s heights, I was on the lookout for a spot where we could relax and let the kids play freely. That’s when I stumbled upon Larvotto Beach, Monaco’s most famous public beach. Set against a backdrop of stunning high-rise buildings and lush greenery, it promised a perfect blend of nature and luxury. The beach is easily accessible, with clear signs guiding visitors from the main roads, making it a hassle-free journey for families with little ones in tow.

This man-made beach is a slice of paradise with its calm waters and pebbly shore, ideal for families looking to unwind.

Larvotto Beach is well-equipped for a family day out. The beach itself is a pebble beach, but don’t let that deter you. The kids quickly found that the pebbles were perfect for building and organizing competitions, which kept them entertained for hours. For me, the clear, calm waters were the highlight. It was reassuring to see that the swimming areas were safeguarded by lifeguards, ensuring a safe environment for the children to splash around in.

What’s remarkable about Larvotto is its array of amenities. From sun loungers and umbrellas available for rent to showers and public restrooms, everything you need for a comfortable day at the beach is at your fingertips. The promenade behind the beach is lined with cafés and restaurants, offering a diverse selection of cuisines. I found it incredibly convenient to grab quick snacks for the kids or indulge in a leisurely lunch with the family, all while enjoying the beautiful sea view.

We also took advantage of the water sports facilities. The kids were ecstatic to try paddleboarding for the first time, and there were options for snorkeling and jet skiing, which looked like a blast. It’s worth noting for families planning to visit that some activities require advanced booking, so checking availability ahead of time is advisable.

Walking along the promenade in the late afternoon, I couldn’t help but appreciate the blend of relaxation and adventure that Larvotto Beach offers. It’s a place where every family member, regardless of age, can find something to enjoy. Whether it’s building pebble castles, swimming in the Mediterranean, or simply soaking up the sun, Larvotto has it all. The amenities, coupled with the beach’s stunning location, make it an unmissable part of any family trip to Monaco.

Soak up the Sun

Larvotto Beach is the perfect spot for families to soak up the sun and enjoy the sea. The beach is well-maintained and offers a safe environment for children to play in the water or build pebble castles on the shore.

Family Facilities and Child Safety

Monaco takes pride in offering a family-friendly environment, and Larvotto Beach is no exception. With lifeguards on duty and a designated swimming area, parents can relax knowing that safety measures are in place. Additionally, there are plenty of nearby restaurants and cafes where families can grab a bite or a refreshing drink.

7. Playing at the Monaco Top Cars Collection

things to do in monaco with kids

8. Playing at the Monaco Top Cars Collection

After a sunny and active morning at Larvotto Beach, I was excited to take my kids to our next adventure: the Monaco Top Cars Collection. Nestled within the terracotta-colored walls of the Terrasses de Fontvieille, this hidden gem offers a fascinating journey through the evolution of luxury and racing cars, a perfect shift of pace for both young minds and adults.

For families with a need for speed, Monaco’s Top Car Collection is a thrilling stop. Located in the Fontvieille district, this museum houses a stunning array of vehicles, from vintage classics to modern supercars.

Walking into the museum, my kids’ eyes lit up at the sight of over 100 gleaming vehicles, ranging from vintage classics to modern-day race cars. Prince Rainier III’s personal collection, each car tells a tale of innovation, speed, and elegance. What’s incredible about this place is the sheer variety of cars on display, making it an engaging experience for anyone, regardless of whether you’re a car enthusiast or not.

The museum is cleverly laid out, allowing visitors to take a self-guided tour at their own pace. Information plaques next to each car provide fascinating insights into the car’s history, design, and performance capabilities. My kids were particularly captivated by the 1952 Rolls-Royce Silver Wraith, marveling at its opulent interior and intricate details. They also couldn’t get enough of the Formula 1 race cars, imagining themselves as race car drivers, speeding down the track to victory.

Interactive elements were a hit too. A few simulators near the Formula 1 section gave them a taste of what it’s like to pilot a high-speed race car. Even I couldn’t resist hopping into a simulator, and let’s just say, it was a humbling experience to “race” alongside my kids.

Not only did the collection provide a cool respite from the midday sun, but it also offered a unique educational opportunity. My kids learned about the advancements in automotive technology and design and the importance of Monaco in the world of racing, especially with its iconic Grand Prix.

As we moved through the collection, the enthusiasm of the staff was infectious. They shared tidbits of history and answered all our questions with a smile, enhancing our experience. We even spotted a workshop area where a car was being restored, which sparked an interesting conversation about the importance of preserving history.

Before we knew it, hours had flown by. The Monaco Top Cars Collection proved to be an enthralling stop in our Monaco itinerary, seamlessly blending education with entertainment.

Vintage Vehicles to Modern Marvels

The collection, personally curated by Prince Rainier III, includes cars that span over a century of automotive history. Children and adults alike will be captivated by the sleek designs and stories behind these magnificent machines.

Little Racers’ Pit Stop Play Area

While the adults marvel at the cars, younger visitors can enjoy the play area designed just for them. With mini cars and interactive exhibits, it’s a place where children can pretend to be race car drivers, igniting their imaginations and creating memories that will last a lifetime.

9. Whimsical Wheels: Le Petit Train de Monaco

things to do in monaco with kids

Every child’s adventure in Monaco should include a ride on Le Petit Train. It’s a delightful way to see the sights without tiring little legs. The train takes you on a tour around Monaco’s most iconic landmarks, with commentary that brings the journey to life.

A Ride Through the Principality

Le Petit Train is a hit with kids because it combines education with entertainment. As you meander through the streets, you’ll learn about the history and culture of Monaco. The train makes several stops, including at the Oceanographic Museum and the Prince’s Palace, making it a convenient way to navigate between attractions.

Little Conductor’s Guide to Sightseeing

Encourage your kids to play the role of little conductors with their very own guide to sightseeing. They can spot landmarks, learn fun facts, and even keep a lookout for the next exciting stop. It’s a playful way to engage them in the day’s adventures.

10. Thrills at Every Turn: Monaco’s Amusement Parks

things to do in monaco with kids

For a break from the cultural and historical outings, Monaco’s amusement parks offer fun-filled activities for families. These parks provide a mix of excitement and relaxation, ensuring that there’s something for everyone.

The Enchantment of the Ni Box

The Ni Box is where fun and games come alive in Monaco. This indoor amusement park offers bowling, arcade games, and even a kids’ club. It’s a perfect place to spend a few hours, especially if you’re looking to escape the midday sun or a rare rainy day.

With a modern and safe environment, parents can relax while kids enjoy the variety of activities available. From laser tag to video games, the Ni Box caters to a range of interests and age groups.

And for those who are feeling hungry after all the play, there’s a snack bar that serves up tasty treats and refreshments. It’s a spot where the entire family can recharge and get ready for more Monaco exploration.

Pro tip: Check the Ni Box’s schedule in advance, as they often host special events and themed nights that can add an extra layer of excitement to your visit.

Monaco’s Carousel and Mini-Golf: Family Fun Fair

No visit to Monaco with kids is complete without a ride on the charming carousel or a round of mini-golf. These classic activities are a hit with families and provide a lovely way to spend an afternoon.

The carousel, with its beautifully painted horses and whimsical music, is a timeless attraction that delights the young and the young at heart. It’s a moment of pure joy and a chance for some great photos.

Adjacent to the carousel is the mini-golf course, where families can engage in a friendly competition. The course is well-designed, offering challenges for all skill levels and plenty of fun obstacles.

Example: The carousel in Monaco is not just a ride; it’s a magical experience that transports you to a world of fantasy and fun.

Conclusion

So there you have it! From sun-soaked afternoons at Larvotto Beach to an immersive journey through the world of luxury and racing cars at the Monaco Top Cars Collection, there’s something for everyone in the family. I’ve found that these experiences not only create lasting memories but also offer unique learning opportunities for kids. They get to see, touch, and learn about the fascinating world of automobiles in a way that’s both fun and educational. And let’s be honest, it’s pretty cool for us adults too! Monaco might be known for its glamour and luxury, but it’s also a place where families can enjoy unforgettable moments together. So pack your bags, and get ready for an adventure that your kids—and you—will remember for years to come.

Frequently Asked Questions (FAQ)

things to do in monaco with kids

When planning a family trip to Monaco, it’s natural to have questions. Here are some of the most commonly asked queries, answered to help you make the most of your visit.

What is the best time of year to visit Monaco with kids?

The best time to visit Monaco with kids is from April to October when the weather is warm and sunny, making it ideal for outdoor activities. However, summer months can be quite busy, so if you prefer a quieter visit, consider late spring or early fall.

-

April to June: Pleasant temperatures and fewer crowds.

-

July to August: Peak tourist season with lots of events.

-

September to October: Warm weather continues, and the tourist rush subsides.

Regardless of when you visit, Monaco offers a wealth of experiences that can be enjoyed year-round.

Are there any child-friendly dining options in Monaco?

Monaco is home to a variety of dining options that cater to families with children. Many restaurants offer kids’ menus, high chairs, and a welcoming atmosphere for little diners. You’ll find everything from casual cafes to fine dining establishments ready to accommodate your family’s needs. For more insights, check out the top things to see and do with kids in Monaco.

What are some free or low-cost activities for kids in Monaco?

Monaco might have a reputation for luxury, but there are plenty of free or low-cost activities for kids. Here are a few:

-

Changing of the Guard at the Prince’s Palace: A free daily event.

-

Stroll through the gardens of Monaco: Public parks and gardens are open to everyone.

-

Public beaches: Larvotto Beach is a great place for a family day out.

Besides these, keep an eye out for festivals and events that often have free or reduced-price activities for children.

How accessible is Monaco for family-friendly transportation?

Monaco is well-equipped to handle family transportation needs. The country is compact, making it easy to get around by foot. For longer distances, buses are available and are both affordable and convenient. Taxis and the aforementioned Le Petit Train are also great options for families.

What kind of accommodations in Monaco are suitable for families?

When it comes to accommodations, Monaco offers a range of options suitable for families. From luxury hotels with child-friendly amenities to vacation rentals that provide more space and kitchen facilities, there’s something for every family’s preference and budget.

Most importantly, look for accommodations that offer conveniences like cribs or rollaway beds, children’s programs, and proximity to attractions to make your stay as comfortable as possible.

by Christal Céleste | Jun 30, 2025 | Style

Key Takeaways

- Monaco summer style revolves around understated luxury with high-quality fabrics rather than flashy logos

- Pack versatile pieces that transition from daytime exploring to evening events with simple accessory changes

- Lightweight linens, silk blends, and breathable cotton are essential for navigating Monaco’s July temperatures (75-85°F)

- Many upscale venues maintain dress codes even in summer – men should pack at least one blazer and collared shirts

- Monaco Beach Club and yacht gatherings have their own distinct style codes that blend sophistication with practical beachwear

Monaco in July demands a wardrobe that balances Mediterranean heat with the principality’s reputation for refined elegance. Unlike casual beach destinations, Monaco’s social scene expects a certain polish even during the summer months, where the quiet whisper of quality speaks volumes over loud designer logos.

Editorialist’s Luxury Shopping Editor notes that Monaco isn’t about “cosplaying with over-the-top theatrics” but rather embraces “subtle polish and poise, with pieces that whisper wealth with a wink of elegance.” This approach defines the perfect Monaco summer wardrobe – sophisticated yet comfortable enough for the season’s heat.

Who Should Read This Article?

This article is an indispensable guide for anyone planning a trip to Monaco, especially during the peak summer month of July. Specifically, it will be most beneficial to:

- First-Time Visitors to Monaco: If you’ve never been to Monaco before and are unsure about its unique dress codes and social etiquette, this article will provide a crucial foundation. It clarifies that Monaco is distinct from typical casual beach destinations.

- Travelers Seeking “Quiet Luxury”: Those who appreciate understated elegance, high-quality craftsmanship, and blending in with a sophisticated crowd rather than flaunting loud brands will find this guide perfectly aligned with their style philosophy.

- Individuals Attending Special Events in Monaco: If your trip includes plans for fine dining, casino visits, yacht gatherings, or exclusive beach clubs, this article offers specific advice on the appropriate attire to ensure you’re dressed for the occasion.

- Packing Strategists: For travelers who want to pack efficiently and create a versatile wardrobe that transitions seamlessly from day to night with minimal items, the packing strategy and essential item lists will be invaluable.

- Men and Women Conscious of Appearance: Both male and female travelers will find tailored advice on fabrics, silhouettes, and accessories to maintain a polished and comfortable look in Monaco’s summer heat.

- Those Aiming to Avoid Tourist Faux Pas: The “What NOT To Wear” section is particularly helpful for anyone wanting to steer clear of common fashion mistakes that can instantly mark them as an unprepared tourist.

- Anyone Planning a Luxury European Summer Vacation: While specific to Monaco, the principles of understated luxury, quality fabrics, and versatile packing can be broadly applied to other high-end destinations along the French and Italian Rivieras or similar European locales.

Monaco’s July Dress Code: Elegant Simplicity Meets Mediterranean Heat

Monaco’s summer dress code can be summarized as effortless elegance with purposeful simplicity. While tourists might be tempted to showcase flashy labels, true Monaco style embraces quality fabrics, impeccable fit, and versatile pieces that transition seamlessly between daytime strolls and evening events. The wealthy residents and regular visitors favor a “quiet luxury” approach – think perfectly tailored linen rather than logo-emblazoned activewear.

Temperature Realities: 75-85°F with High Humidity

July temperatures in Monaco typically hover between 75-85°F (24-29°C), with humidity levels that can make it feel warmer. Early mornings and evenings bring refreshing Mediterranean breezes, while midday sun can be intense, especially when reflecting off the water at Monaco’s beach clubs and marina. This creates the first wardrobe challenge: staying comfortably cool while maintaining the polished appearance expected in Monaco’s social spaces.

The principality’s compact nature means you’ll likely walk between destinations, navigating Monaco’s famous hills and stairs. Breathable fabrics become essential, as does a layering strategy that accommodates air-conditioned interiors and warm outdoor terraces. For more tips on dressing appropriately, check out this guide on what to wear in Monaco.

Monaco July Weather at a Glance

Average High: 82°F (28°C)

Average Low: 70°F (21°C)

Humidity: 65-75%

Rainfall: Minimal (1-2 days)

Sunshine Hours: 10+ daily. For more ideas on how to enjoy your time, check out what to do in Monaco in one day.

When planning a trip to Monaco in July, it’s important to consider the weather and local fashion trends. The summer months in Monaco are typically warm and sunny, making lightweight and breathable clothing a must. For more detailed insights on what to pack, check out our guide on what to wear in Monaco in June as it provides useful tips that can be applied to July as well.

Day-to-Night Fashion Strategy

The key to mastering Monaco summer style lies in selecting pieces that transition effortlessly from day to evening with minimal changes. For women, this might mean a silk slip dress that works for both café lunches and dinner when paired with different accessories. For men, tailored shorts and a linen shirt can shift to evening-appropriate by swapping in lightweight trousers and adding a soft blazer. The strategic Monaco packer brings versatile pieces in complementary colors that can be mixed, matched, and transformed with the right accessories.

Understated Luxury Over Flashy Labels

Monaco style is less flamboyant and logo-centric than visitors might expect. The true hallmarks of Monaco summer fashion include quality materials, excellent fit, and timeless silhouettes. Think ready-to-wear pieces from Loro Piana, Brunello Cucinelli, and Hermès rather than heavily branded items. This “whispered wealth” approach defines Monaco’s most stylish residents and regular visitors, who recognize each other through quality rather than obvious status symbols. For more insights on seasonal fashion, check out what to wear in Monaco in June.

When selecting your Monaco wardrobe, prioritize natural fabrics that breathe well and maintain their shape even in humidity. A well-cut linen shirt will always impress more than a logo-heavy alternative, regardless of the designer name. This approach allows you to blend in with Monaco’s sophisticated crowd rather than standing out as a tourist.

Daytime Essentials for Monaco’s Summer Heat

Daytime in Monaco balances practical comfort with elegant presentation. As you move between the famous Casino Square, the stunning Oceanographic Museum, and perhaps Port Hercules to admire the yachts, your outfit needs to withstand both sun and the social scene. A light color palette dominates for practical reasons – whites, creams, tans, and soft blues reflect heat while complementing the Mediterranean backdrop. For more ideas on what to do, check out what to do in Monaco in one day.

Breathable Fabrics That Keep You Cool and Polished

The foundation of any Monaco summer wardrobe lies in selecting the right fabrics. Lightweight linens, cotton-silk blends, and fine poplins deliver the breathability needed for July temperatures while maintaining a crisp, elegant appearance. For women, flowing silk midi skirts paired with simple cotton tops offer comfort without sacrificing style. Men should prioritize linen-cotton blend shirts and lightweight chinos or tailored shorts in neutral tones.

Wrinkles are inevitable with natural fabrics in summer heat – embrace this as part of the Mediterranean aesthetic rather than fighting it with synthetic alternatives. The natural texture of slightly rumpled linen conveys the relaxed confidence that defines Monaco’s summer style.

Yacht-Ready Pieces That Transition From Marina to Café

Monaco’s port is lined with some of the world’s most impressive yachts, and chances are you’ll find yourself harbor-side or even invited aboard during your stay. The ideal yacht-ready wardrobe combines practicality with that unmistakable Riviera flair. For women, lightweight cotton pants in white or navy paired with striped tops channel timeless nautical elegance while remaining comfortable. Men should consider tailored shorts that hit just above the knee in navy or stone, paired with well-fitted polo shirts or linen button-downs.

Footwear deserves special consideration – opt for deck-friendly options like leather sandals for women or driving shoes for men that won’t mark yacht surfaces but still look appropriate when you step off for lunch. A lightweight layer like a fine cotton cardigan or unlined blazer proves invaluable when sea breezes pick up. For more ideas on Monaco outfits in summer, explore these curated styles.

Beach Club Attire: What Sets Monaco Apart

Monaco’s beach clubs – particularly the famous Monte Carlo Beach Club and Larvotto Beach – demand a more elevated approach to beachwear than you might pack for other destinations. The beach club scene blends relaxation with social positioning, requiring thoughtfully curated swimwear and cover-ups that maintain elegance even poolside.

Women should consider high-quality one-piece swimsuits or well-designed bikinis in solid colors rather than trendy patterns. Your beach cover-up should be substantial enough to wear to lunch – think linen shirt dresses or elegant caftans rather than sheer throw-ons. Men navigate beach clubs successfully with tailored swim shorts (avoid overly long board shorts) in solid navy, black, or subtle patterns, paired with crisp linen shirts left unbuttoned over dry tees. For more tips on dressing for the season, check out our guide on what to wear in Monaco in June.

Footwear That Balances Comfort and Style

Monaco’s terrain presents unique footwear challenges with its hills, stairs, and mix of surfaces from cobblestones to marble. While stilettos might look glamorous outside the casino, they’re impractical for daily exploration. Instead, women should pack leather sandals with small block heels or quality flats from brands known for comfort without sacrificing style – think Hermès Oran sandals or Chanel ballerinas rather than obvious tourist footwear.

Men need equally versatile options – leather loafers without socks present the quintessential Riviera look, while quality driving shoes offer more comfort for extended walking. In both cases, break in your shoes before traveling to ensure they can handle Monaco’s varied terrain without causing discomfort.

Evening Fashion That Turns Heads in Monte Carlo

As the Mediterranean sun sets, Monaco transforms into one of Europe’s most sophisticated nightlife destinations. Evening in Monaco demands a clear elevation from daywear, though still within the principality’s understated aesthetic. This is where having versatile pieces that transform with the right accessories proves invaluable.

Casino Dress Codes Decoded

The legendary Casino de Monte-Carlo maintains dress codes even during summer months. After 8 PM, men are expected to wear jackets in the private gaming rooms, though the main floor is slightly more relaxed. A lightweight summer blazer in navy or neutral tones paired with crisp trousers and a collared shirt meets requirements without causing discomfort. Women should aim for cocktail attire – a silk midi dress or elegant separates with heels convey the appropriate level of sophistication.

Remember that while some dress codes have relaxed slightly in recent years, Monaco’s casinos still appreciate efforts to maintain their glamorous heritage. When in doubt, err on the side of formality – you’ll never feel out of place being slightly overdressed in Monaco’s evening venues.

Restaurant Requirements: Where Jackets Are Still Expected

Monaco’s finest restaurants like Le Louis XV-Alain Ducasse and Yoshi maintain jacket requirements for men even in July. Before reservations, always check current dress codes – many establishments post these on their websites. For women, evening dining calls for elegant dresses or sophisticated separates that wouldn’t look out of place at a cocktail event. If you’re planning to visit in other months, here’s a guide on what to wear in Monaco in May.

The true mark of Monaco dining style isn’t flashiness but appropriate elegance for the venue. A three-Michelin-star experience demands different attire than a seaside taverna, though both require thought and care. Accessories make the difference here – the right jewelry, watch, or evening bag elevates simpler outfits to meet Monaco’s standards.

Nightclub Style That Balances Glamour and Comfort

Monaco’s famous nightclubs like Jimmy’z and Twiga combine Mediterranean energy with exclusivity. The nightlife dress code embraces glamour while acknowledging the warm July nights. Women often opt for cocktail dresses in breathable fabrics or elegant jumpsuits, paired with statement accessories and heels. Men typically wear tailored trousers with crisp shirts, often forgoing ties but maintaining an overall polished appearance.

The key distinction in Monaco nightlife style versus other destinations is the consistency of elegance throughout the night – even as the hours grow late, Monaco’s club scene maintains its sophisticated edge rather than devolving into casual partywear. Pack pieces that can handle both dancing and maintaining your composure until sunrise.

Essential Accessories For Monaco’s Social Scene

In Monaco, accessories often tell the true story of style sophistication. Rather than competing with louder styles, Monaco’s most elegant visitors use accessories to communicate subtle refinement. The right selections can transform basic pieces into outfits worthy of the principality’s most exclusive settings.

Sunglasses: Your Most Important Daytime Statement

Quality sunglasses serve dual purposes in Monaco – protecting against the intense Mediterranean sunlight and completing your daytime aesthetic. Classic shapes from Persol, Ray-Ban, or Vuarnet offer timeless appeal without obvious branding. Avoid overly trendy styles or heavily logoed options in favor of frames that complement your face shape and coordinate with multiple outfits. For more tips on dressing in the region, check out our guide on what to wear in Monaco in June.

The best approach is investing in one exceptional pair rather than packing multiple options. Look for polarized lenses that perform well both on land and reflecting off the water at beach clubs or aboard yachts. Your sunglasses should seamlessly transition between morning shopping, afternoon sun, and early evening aperitifs. For more insights on style, check out this guide on what to wear in Monaco.

Jewelry That Signals Taste Without Trying Too Hard

Monaco jewelry style embodies the “less is more” philosophy even during evening events. Delicate gold pieces, single statement items, or family heirlooms communicate sophistication more effectively than matching sets or trendy statement pieces. For daytime, minimal jewelry works best – perhaps just a quality timepiece and simple earrings. Evenings might call for something more substantial, but still within the realm of understated elegance.

Men should consider minimal accessories beyond a quality watch – perhaps a simple bracelet or subtle cufflinks for evening events. The goal is complementing rather than dominating your overall appearance, allowing quality and fit to remain the focus.

The Perfect Day-to-Evening Bag

Bag selection proves particularly important in Monaco, where carrying the right accessory signals your understanding of occasion-appropriate style. During daytime exploration, a medium-sized crossbody or tote in quality leather accommodates essentials while leaving hands free. For evening transitions, a small clutch or pochette transforms your look without requiring a complete outfit change. If you’re planning a short visit, here’s a guide on what to do in Monaco in one day to make the most of your time.

The most strategic approach is packing one daytime option and one evening alternative, both in neutral tones that coordinate with your entire wardrobe. Quality matters more than recognizable logos – a beautifully crafted leather bag without obvious branding often receives more appreciative glances than the latest “it bag.”

Sun Protection That Complements Your Look

July in Monaco means serious sun exposure, but protection can remain stylish. Wide-brimmed hats in natural materials like straw or lightweight linen shield your face while complementing summer outfits. Men might consider panama hats or light cotton options rather than obvious baseball caps. The key is selecting sun protection that appears intentional rather than hastily added – your hat should look like a considered part of your outfit rather than a practical afterthought.

7 Must-Pack Items For Women Visiting Monaco in July

When condensing Monaco style into a manageable packing list, these seven items create the foundation for a week of sophisticated summer outfits that transition seamlessly between daytime and evening events. If you’re planning to explore the city, consider these things to do in Monaco in one day to make the most of your visit.

1. The Versatile White Linen Dress

A well-cut white linen dress serves as perhaps the most versatile piece in a Monaco summer wardrobe. Wear it with flat sandals and minimal jewelry for daytime exploration, then transform it with metallic accessories and elegant sandals for evening drinks. Look for a silhouette that flatters your figure without appearing constricting – Monaco summer style embraces a relaxed elegance rather than obvious bodycon shapes.

The ideal linen dress hits just below the knee, features minimal hardware or embellishment, and maintains its structure even in humid conditions. Natural off-white tones often prove more sophisticated than bright optical white, especially as the garment develops a lived-in patina throughout your trip.

2. Tailored Shorts in Neutral Tones

Elevated shorts in linen-cotton blends work perfectly for Monaco’s casual-but-put-together daytime aesthetic. Look for tailored styles with proper closures rather than drawstrings, and lengths that hit mid-thigh rather than very short cuts. Neutral tones like ivory, tan, or navy pair easily with multiple tops, creating different looks from the same foundation piece.

These shorts should be styled thoughtfully – paired with silk blouses rather than t-shirts, and accessorized with leather sandals and quality bags rather than casual canvas options. The distinction between tourist shorts and Monaco-appropriate shorts lies entirely in styling and fabric quality.

3. Silk Camisoles for Layering

Lightweight silk camisoles or shells provide the perfect layering piece for Monaco’s variable temperatures. These can be worn alone with tailored bottoms during peak daytime heat, then layered under jackets or cardigans for evening transitions. Investing in three or four colors that complement your bottoms creates multiple outfit options from a minimal packing list.

Look for slightly relaxed cuts rather than skin-tight styles, and consider subtle details like delicate straps or a draped neckline that elevate these basics beyond simple tank tops. Proper silk properly cared for maintains its elegance even in humid conditions.

4. A Lightweight Blazer for Evening Transitions

An unlined or partially lined summer blazer transforms daytime pieces for evening events while providing practical warmth when sea breezes pick up. Navy, cream, or soft neutral tones offer maximum versatility. The ideal cut provides structure without stiffness, allowing comfortable movement while maintaining a polished silhouette.

This piece will likely be your most frequently used evening layer, so prioritize quality and fit even if it represents a larger investment. A well-chosen blazer elevates everything from dresses to tailored shorts, making it the cornerstone of day-to-night transitions.

5. Classic One-Piece Swimwear

Monaco beach clubs call for sophisticated swimwear rather than trendy styles you might choose for other destinations. A well-designed one-piece in a solid color offers timeless elegance while providing practical coverage for transitions between swimming and beachside dining. Look for architectural details like subtle cutouts or interesting back designs rather than prints or embellishments. If you’re planning to visit in the summer, here’s some advice on what to wear in Monaco in June.

The most versatile options include black, navy, or deep burgundy – colors that photograph well and pair easily with different cover-ups. For those planning a trip, knowing what to wear in Monaco in May can be helpful. Quality construction matters significantly here, as does finding a suit that flatters your natural shape rather than fighting against it.

6. Comfortable Yet Elegant Walking Sandals

Monaco’s terrain demands footwear that balances comfort with sophistication. Leather sandals with supportive soles and minimal hardware navigate this requirement perfectly. Metallic tones like gold or silver prove surprisingly versatile, complementing multiple outfit colors while adding subtle elegance to simple daytime looks.

The ideal walking sandal has a slight heel or platform for urban polish but remains comfortable for hours of exploration. Avoid obviously touristy options with visible sports branding or excessive straps and buckles, opting instead for clean designs that wouldn’t look out of place at an upscale lunch venue.

7. A Statement Sundress for Yacht Events

While Monaco style generally embraces understated elegance, one statement piece proves worthwhile for special occasions like yacht parties or high-profile lunches. A midi or maxi dress in a bold solid color or sophisticated print communicates confidence and celebrates the Mediterranean setting. Look for flowing silhouettes in natural fabrics that move beautifully in sea breezes.

This piece should require minimal accessories – perhaps just simple metallic jewelry and elegant sandals. The dress itself provides the visual interest, making it ideal for photo-worthy Monaco moments while remaining appropriate for the principality’s elegant social scene.

6 Essential Pieces For Men in Monaco During July

Men navigating Monaco’s summer dress codes need fewer pieces than women but should focus intensely on fit, fabric, and versatility. These six essentials create a comprehensive wardrobe for everything from daytime exploration to evening events. For more inspiration, check out this guide on what to wear in Monaco.

1. Linen Shirts in Blues and Neutrals

Well-cut linen shirts in pale blue, white, and neutral tones form the foundation of a Monaco summer wardrobe for men. These should be properly sized rather than oversized, with attention to collar construction and button quality. During daytime heat, these can be worn slightly unbuttoned with sleeves rolled precisely, then buttoned appropriately for evening transitions.

The distinction between tourist linen and Monaco-appropriate linen lies in quality and care – invest in pieces with proper weight that hold their shape even in humidity. Natural wrinkles are expected and even appreciated as part of the Mediterranean aesthetic.

2. Tailored Cotton-Blend Trousers

Lightweight trousers in cotton-linen blends provide the foundation for both daytime and evening looks. Navy, beige, and stone colors offer maximum versatility. The ideal cut is slightly relaxed through the leg while maintaining a clean line – avoid both skinny fits that appear restrictive and overly loose styles that read as casual.

These trousers should hit exactly at the shoe with minimal or no break, creating a clean silhouette. While more casual than wool alternatives, they should still maintain proper tailoring details like proper closures and well-finished seams.

3. A Navy Blazer That Breathes

An unlined or partially lined navy blazer in summer-weight wool, cotton, or linen blend serves as the most important transformative piece in a man’s Monaco wardrobe. This single item elevates casual daytime pieces for evening events and ensures entry to venues with jacket requirements. Soft shoulders and minimal structure work best for both comfort and the relaxed Mediterranean aesthetic.

The ideal blazer appears equally appropriate with tailored shorts during daytime or paired with trousers for evening dining. Look for details like patch pockets and natural buttons rather than flashy hardware or contrast stitching that might read as trying too hard.

4. Quality Loafers That Transition From Day to Night

A single pair of well-crafted leather loafers in medium brown or navy serves nearly all Monaco footwear needs. These should be broken in before traveling to ensure comfort during extended walking. The most versatile styles have minimal hardware and clean lines, avoiding both overly casual boat shoe elements and formal dress shoe details.

These can be worn sockless during daytime heat, then paired with invisible socks for evening events. The distinction between tourist footwear and Monaco-appropriate options lies in leather quality and subtle design rather than obvious branding or trendy shapes.

5. Breathable Polo Shirts

Cotton pique or cotton-silk blend polos provide slightly more polished alternatives to t-shirts while maintaining comfort in July heat. Navy, white, and soft blues offer maximum versatility. The ideal fit skims rather than clings to the body, with sleeves that hit mid-bicep rather than extended basketball-style cuts or very short sleeves.

These can be paired with tailored shorts during peak daytime heat, then transitioned under blazers for casual evening events. Look for quality details like mother-of-pearl buttons and reinforced collars that maintain their shape throughout the day.

6. Swim Shorts That Double as Casual Wear

Monaco beach clubs and yacht gatherings call for elevated swim shorts rather than casual board styles. Look for tailored options with proper closures and side adjusters rather than drawstring-only alternatives. Solid navy, hunter green, or burgundy offer sophisticated alternatives to bright prints or obvious patterns.

The ideal length hits mid-thigh rather than extending below the knee or cutting too high. These should be able to transition from swimming to casual lunch when paired with a linen shirt, making them true double-duty pieces rather than strictly swimwear.

What NOT To Wear in Monaco (Even in the Heat)

Understanding Monaco’s style parameters includes recognizing what doesn’t work in this sophisticated setting. Even July heat doesn’t excuse certain casual elements that immediately mark visitors as tourists rather than savvy travelers who understand the principality’s aesthetic.

Tourist Giveaways to Avoid

Certain items immediately signal tourist status regardless of their designer label or price point. Athletic sneakers paired with non-athletic clothing, visible logos across clothing or accessories, and overly casual elements like cargo shorts or flip-flops mark wearers as outsiders to Monaco’s style ecosystem. Similarly, baseball caps, especially those worn backward, read immediately as inappropriate regardless of the venue.

Technology accessories require special consideration – avoid wearing cameras around your neck or keeping phones in visible lanyards. Instead, use discreet bags that protect these items while maintaining your overall aesthetic. For more style tips, check out our guide on what to wear in Monaco in April.

Beach Attire That Doesn’t Transition to Town

Monaco’s compact nature means you’ll likely move between beach activities and town exploration, but beachwear should remain at the beach. Cover-ups that are essentially transparent, rubber flip-flops regardless of their designer label, and overly revealing swimwear worn beyond beach club boundaries immediately identify wearers as unfamiliar with local customs. Men should never wear swim shorts without proper shirts in town settings, regardless of proximity to the water.

The key distinction is between practical beachwear and elevated resort wear that allows seamless transitions. Invest in pieces that serve both purposes rather than requiring complete changes between activities.

Overdone Looks That Appear Try-Hard

Monaco’s true style centers on effortless elegance rather than obvious effort. Avoid ensembles that appear too coordinated or contrived – matching sets can read as costumey rather than sophisticated. Similarly, excessive jewelry, visible designer labels, or “look at me” elements like ultra-mini lengths or extreme cutouts often communicate insecurity rather than confidence in this setting.

The most elegant Monaco visitors understand that true sophistication whispers rather than shouts. When uncertain, always err on the side of simplicity and quality over complicated styling or trend-focused choices.

Monaco Style Red Flags

– Athletic sneakers with non-athletic clothing

– Visible logos and branding

– Baseball caps in town settings

– Flip-flops beyond the beach

– Overly revealing beachwear in town

– Excessive matching or coordination

– Ultra-trendy pieces that sacrifice comfort

The principality’s most stylish residents and visitors understand that confidence comes from appropriate, well-fitting clothing rather than attention-seeking choices. Your wardrobe should support your experiences rather than demanding attention itself.

When observing truly elegant Monaco regulars, you’ll notice their outfits rarely contain memorably flashy elements – instead, you remember an overall impression of appropriate sophistication that appeared effortless rather than calculated. For more insights on dressing appropriately, check out this guide on what to wear in Monaco in June.

Packing Strategy: How to Fit Monaco Style into One Suitcase

Creating a versatile Monaco wardrobe within limited luggage constraints requires strategic planning rather than last-minute selections. The key lies in thoughtful curation of pieces that work together in multiple combinations rather than single-use outfits that consume valuable space.

Begin by mapping potential activities against required outfits, identifying opportunities for pieces to serve multiple purposes. A midi skirt that works for both daytime shopping and evening dining when paired with different tops creates more value than separate outfits for each occasion.

Color Palette Planning for Maximum Versatility

Building a Monaco wardrobe around a consistent color story maximizes versatility while minimizing required pieces. Select a foundation of neutrals – navy, ivory, tan, and perhaps one accent color like soft blue or burgundy that flatters your complexion. This approach ensures every top works with every bottom, creating numerous outfit options from minimal pieces. For more specific tips, check out our guide on what to wear in Monaco in May.